Q4 Turning Point

Investing Environment Review and Outlook – Volume 64

Q4 Turning Point

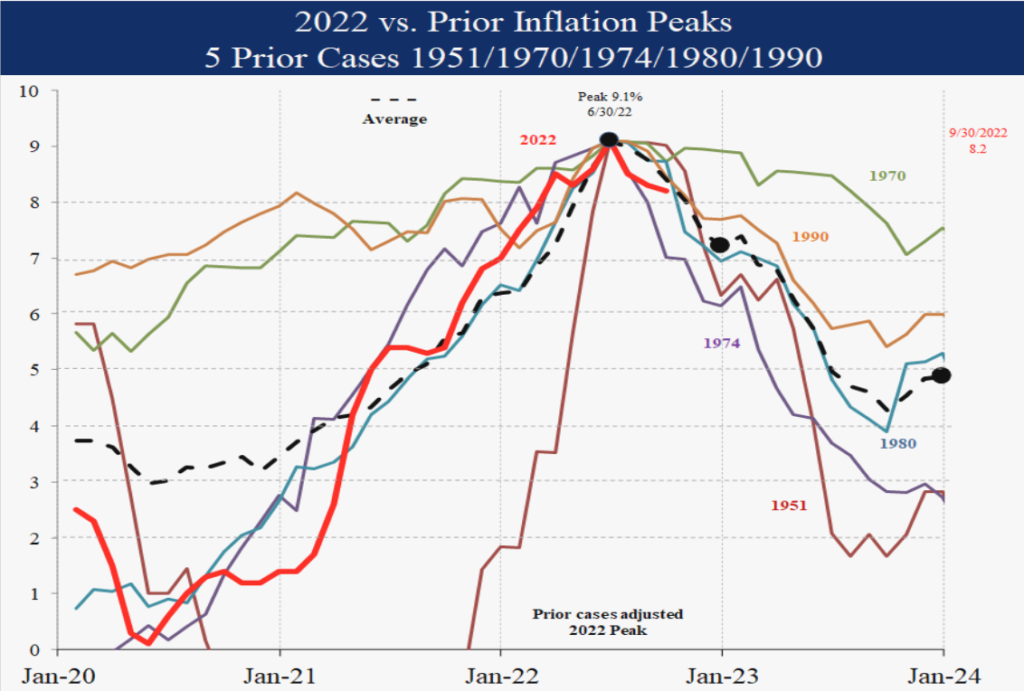

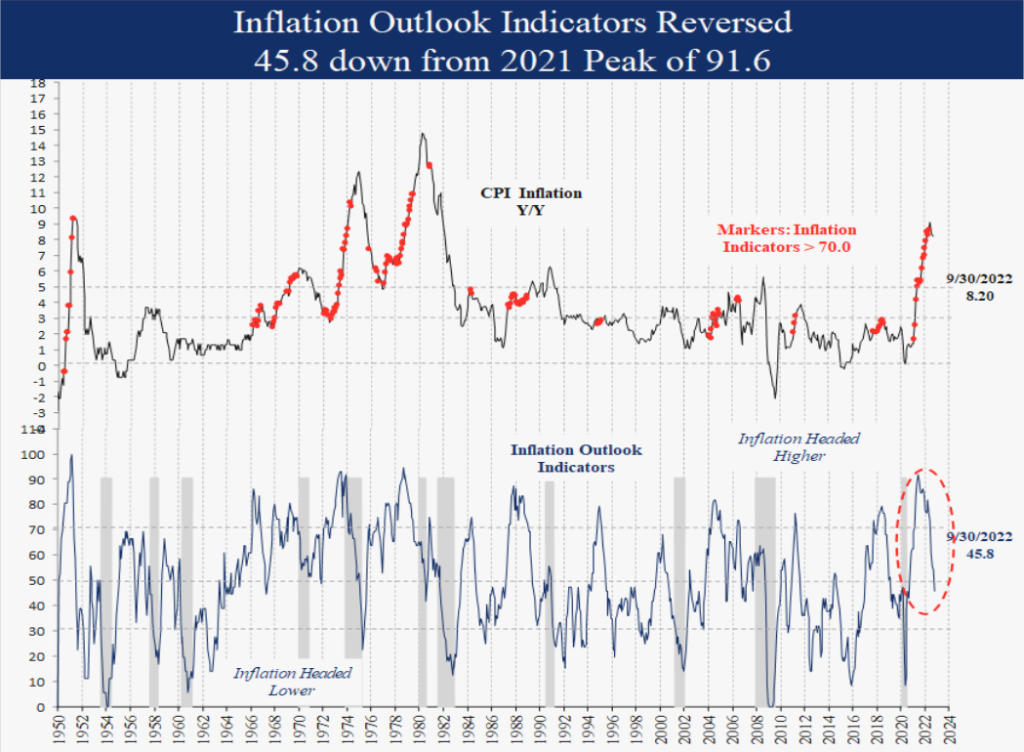

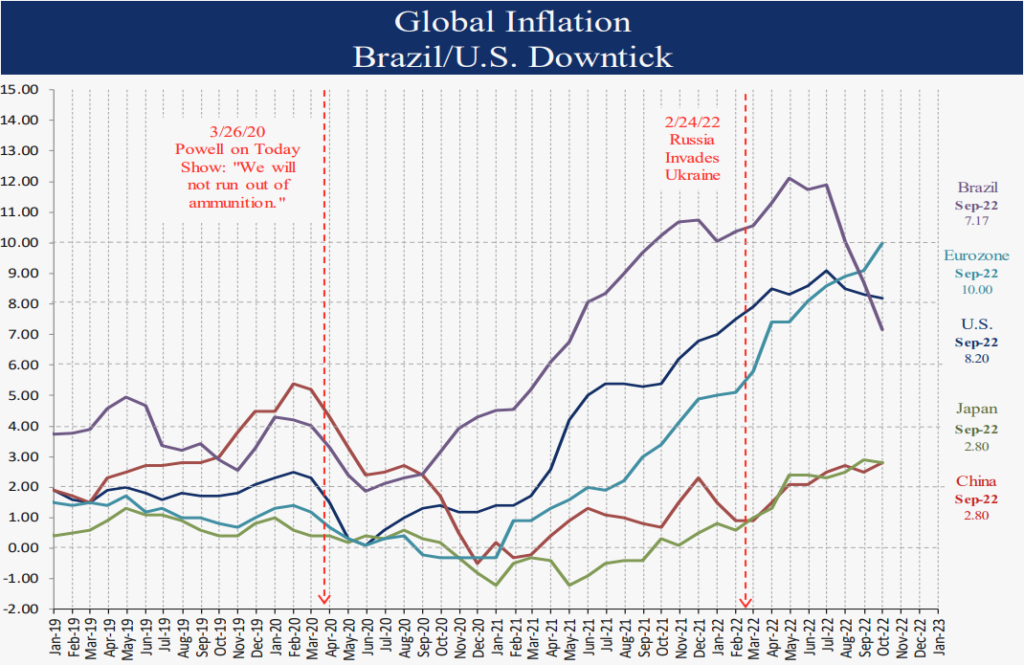

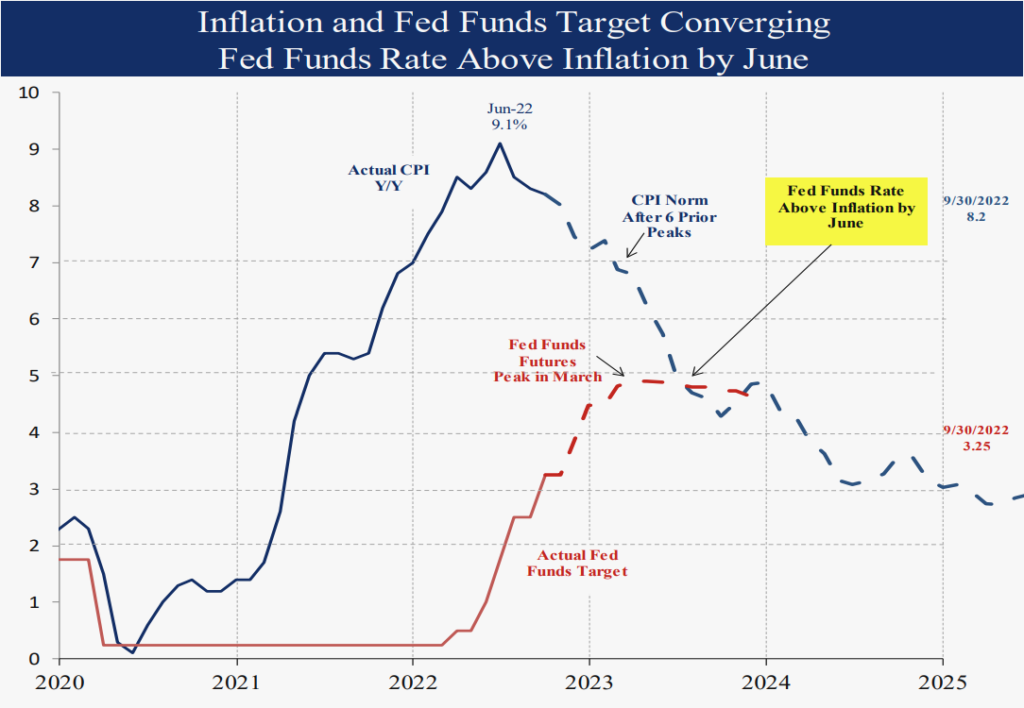

Last month we discussed the positive implications of the non-Fed related drivers of lower inflation and the opportunity in equities amid the pervasive investor gloom. Despite the upside inflation surprise in the core inflation reading last week (6.6% vs. 6.3%), headline inflation continued lower in line with prior peaks (8.2% down from the 9.1% June peak). The norm for prior cases after inflation peaks reaches 7% by December and 5% by June 2023. The implications of still high but falling inflation, record low investor positioning and the positive fourth quarter seasonality remain significantly positive for equities.

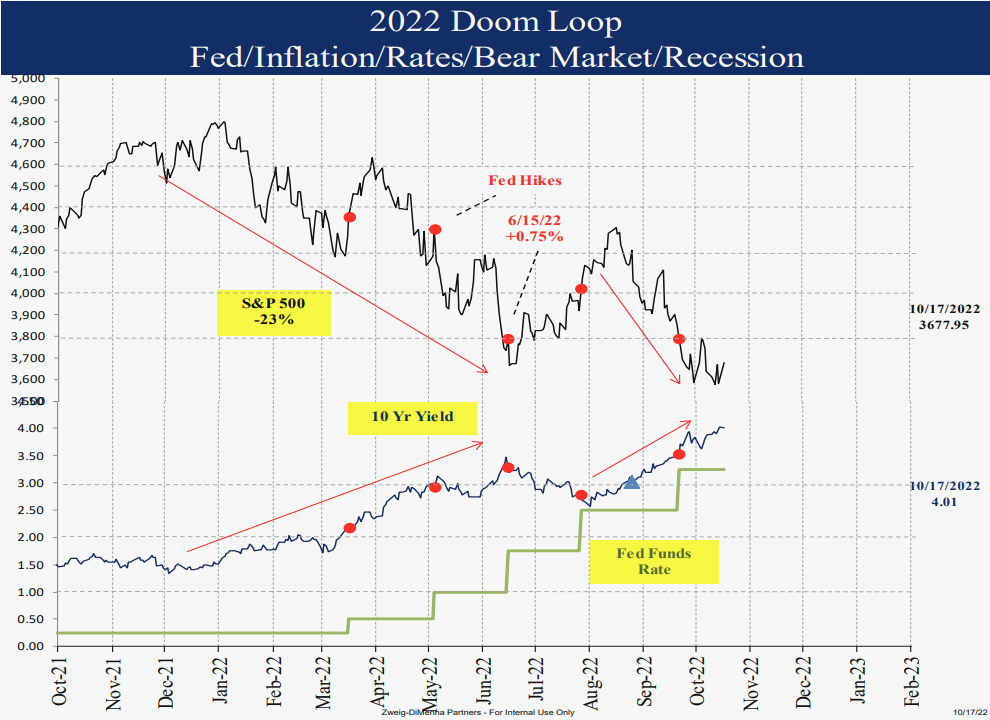

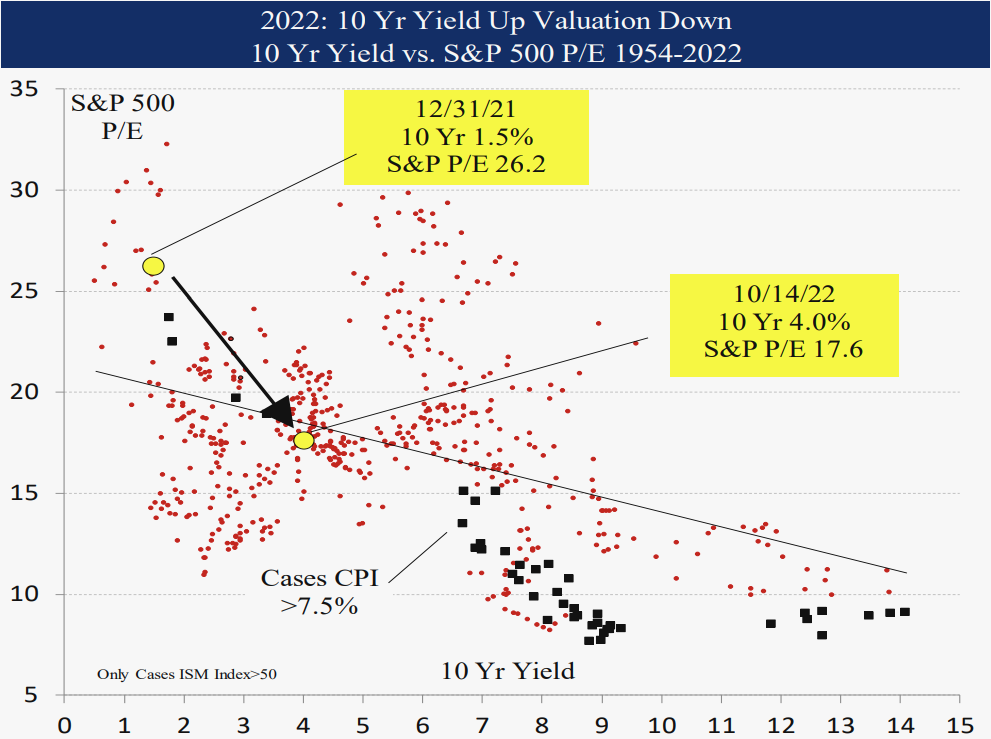

This month we shift our focus to the positive implications of the likely peak in Treasury yields despite further Fed hikes ahead. We also look at the consensus GDP forecast pattern showing a trough in Q1 then higher by year-end 2023.

We increased U.S. and foreign-developed equities to a bullish 4 rating. Emerging markets remain a bullish 4. We increased long-term bonds to a bullish 4. Gold remains a bullish 5 and commodities are a neutral 3.

Fed Pause Starts in March: Positive for Equities

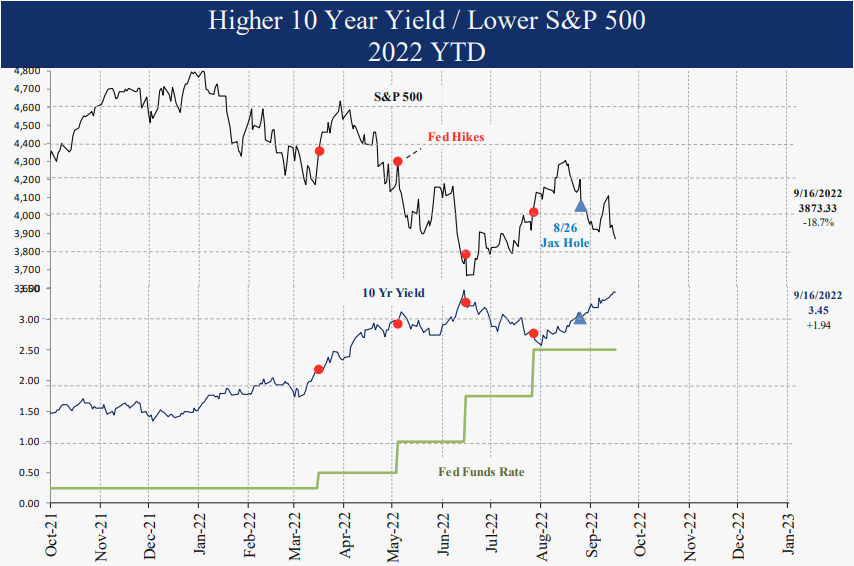

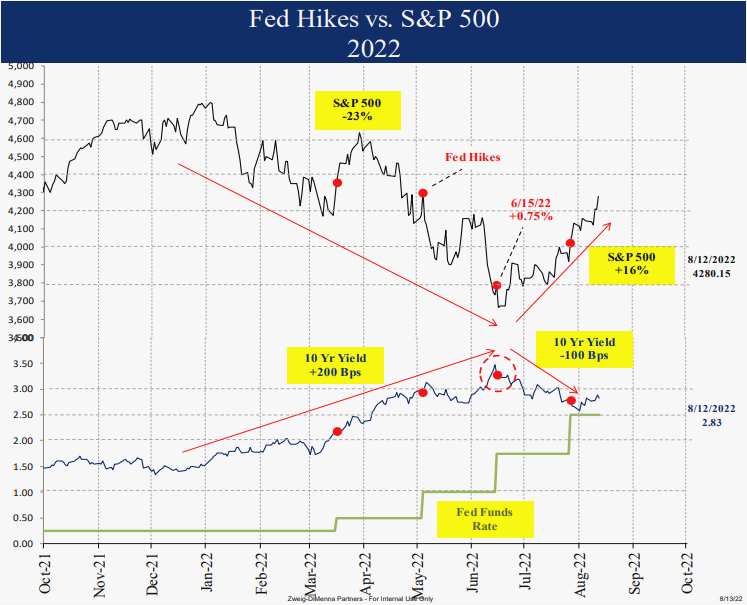

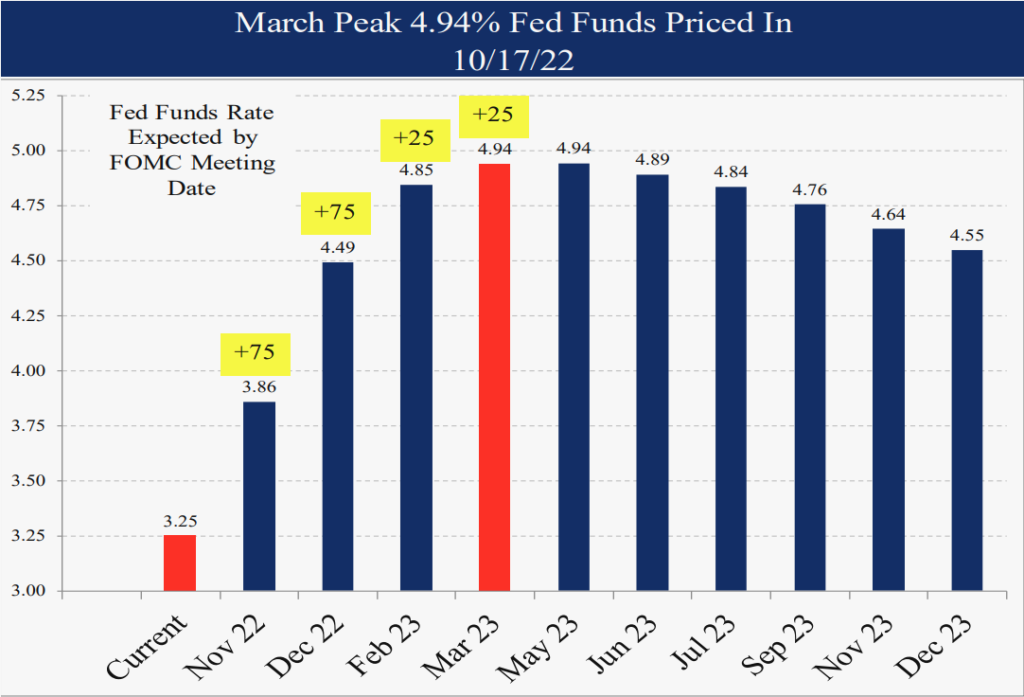

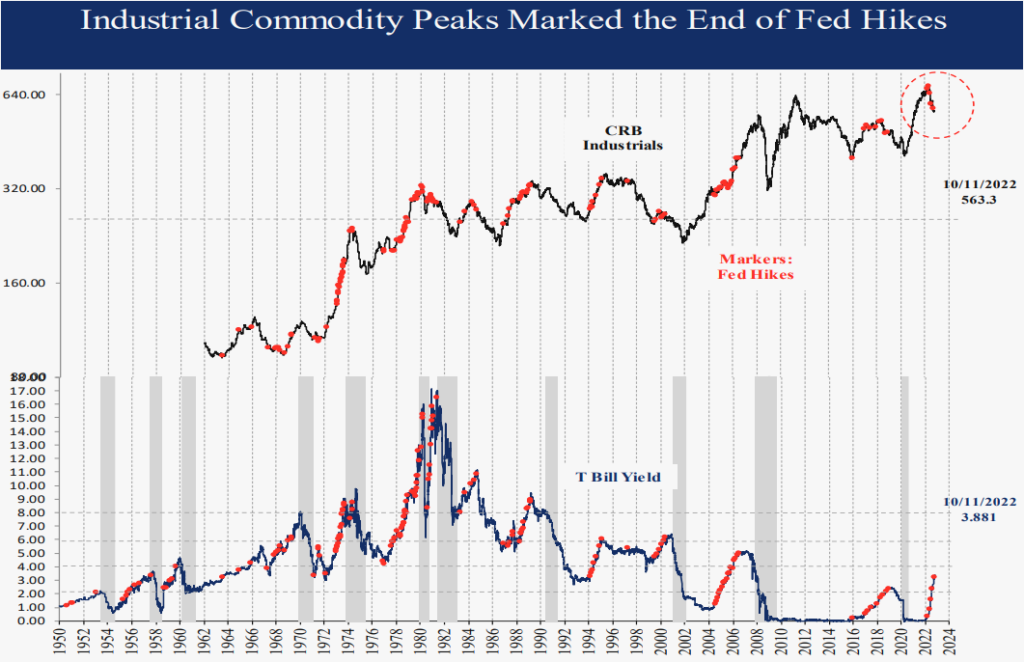

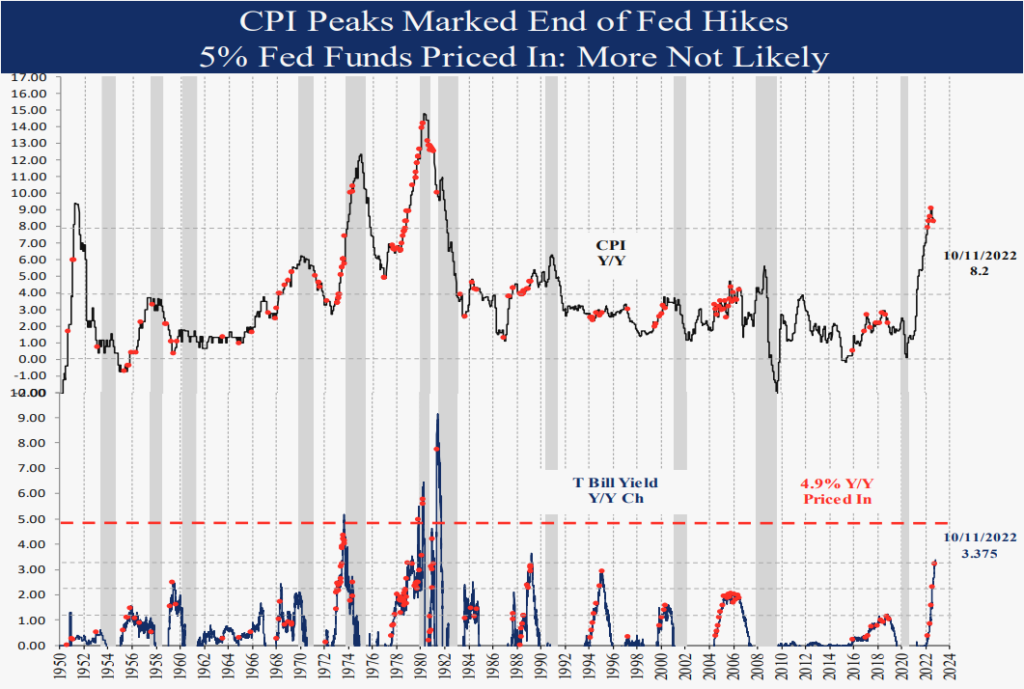

With Fed Funds at 3.25% and inflation at 8.2%, there is no question the Fed will hike further. In fact, the futures market has priced in rate hikes at the next four meetings with a March peak just under 5%. This appears negative for equities; however, it is the direction of market rates like the 2-year Treasury yield and the 10-year which have driven stock prices this year. Rising expectations for Fed hikes have driven these longer maturity market rates higher as well, despite indicators like weak industrial commodities and break-even inflation rates of just 2.3% which normally push interest rates lower.

Consider the Fed has only raised rates over 5% within 12 months twice in 109 years of existence. Those were in 1980 and 1981 when inflation was not only higher, but also still rising. Second, in prior cycles, CPI and commodity peaks like today marked the end of hiking cycles and peak in rates. Finally, the falling CPI means the Fed Funds target rate and CPI inflation are converging rapidly. An average of prior inflation peak cases shows the CPI will be below the expected 5% Fed Funds level by June, allowing the Fed to pause, particularly because they will not yet know the lagged effect of all their hikes to date.

The bottom line is that, if as expected, with no further hikes to be priced in above 5%, market interest rates like the 2-year and 10-year yield, which have been powerful drivers against equities, have likely peaked for now. In prior cases when extreme upside moves in rates like this reversed, it marked a low in equities.

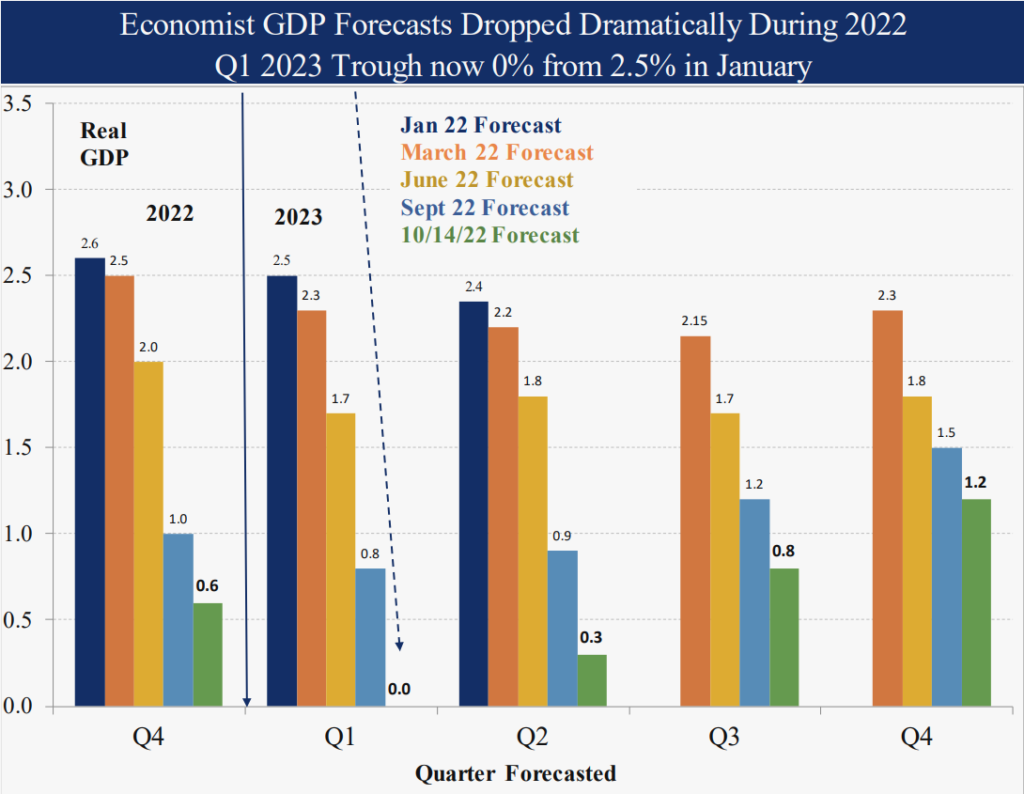

Consensus Economic Forecast Dropped this Week: Trough in Q1 Positive for Equities

The consensus economic forecast dropped dramatically this month to a trough of 0% in Q1, down from 2.5% expected last January. While this could certainly drop further, the Q1 trough is significant since equities bottom ahead of the economy. While prior cycles showed variable lead times, a Q1 trough in GDP would be consistent with a Q4 low for stocks.

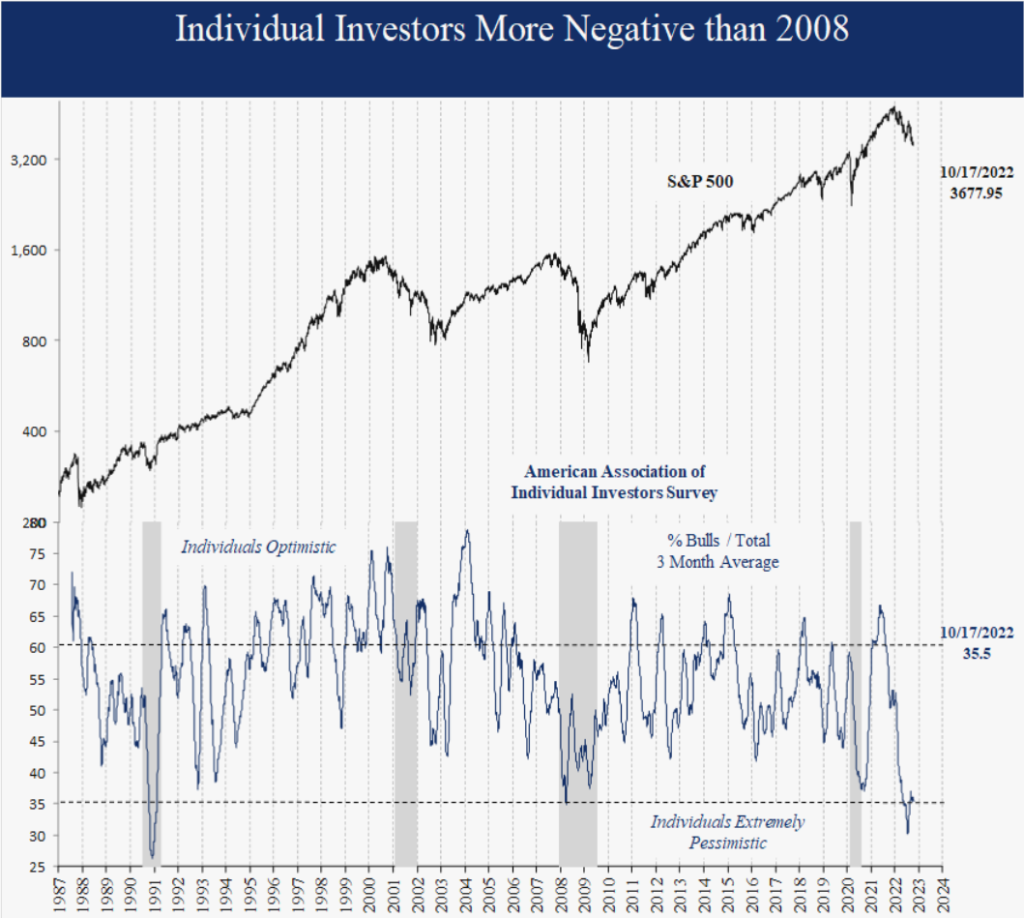

Individual Investor Positioning More Negative than 2008: Cash on the Sidelines

Last month we showed institutions were more negative than during the Global Financial Crisis in 2008 when the S&P 500 declined over 50%. Individual investors were also more negative this year than 2008, with an extreme low reading going back 32 years to 1990. Extreme investor positioning is never a catalyst for a turn in the opposite direction, but it does set the stage for a reversal much like a dry forest does not cause a forest fire but increases the risk. It represents extreme liquidity in portfolios available to drive stocks higher.

Summary

Last month we outlined the positives of falling inflation, extreme investor positioning and Q4 seasonality, which remain today. This month we discussed why market yields like the 2 year and 10-year Treasuries are likely peaking, which will remove one of the biggest headwinds of the year for equities. While it may seem logical to wait for a Fed pivot, historical cases show equities will move to the upside ahead of the Fed just like they did to the downside this year ahead of the initial March hike. This was the case in the 1994 hiking cycle as well, when the S&P 500 bottomed in December soon after the 10-year yield peaked, both despite the final hike over a month later in 1995. The initial Fed cut was not until July when the S&P 500 was already up 22% from the low. Our research is clear about upside potential for equities, but it does not mean the bear market is over. We will continue to monitor our indicators on a daily basis for any significant changes to our outlook. Thank you for your support and please contact us with any questions.

IMPORTANT DISCLOSURES

This review and outlook report (this “Report”) is for informational, illustration and discussion purposes only and is not intended to be, nor should it be construed as, financial, legal, tax or investment advice, of Brenton Point Wealth Advisors LLC or any of its affiliates (“Brenton Point”). This Report does not take into account the investment objectives, financial situation, restrictions, particular needs or financial, legal or tax situation of any particular person and should not be viewed as addressing any recipient’s particular investment needs. Recipients should consider the information contained in this Report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments.

This material is based upon information obtained from various sources that Brenton Point believes to be reliable, but Brenton Point makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated and are subject to change without notice.

This Report contains certain forward looking statements opinions, estimates, projections, assessments and other views (collectively “Statements”). These Statements are subject to a number of assumptions, risks and uncertainties which may cause actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by these forward looking statements and projections. Brenton Point makes no representations as to the reasonableness of such assumptions or the likelihood that such assumptions will coincide with actual events and this information should not be relied upon for that purpose. Changes in such assumptions could produce materially different results. Past performance is not a guarantee or indication of future results, and no representation or warranty, express or implied, is made regarding future performance of any financial instrument mentioned in this Report.

Any benchmark shown herein is shown for illustrative purposes only. No index benchmark is available for direct investment. It may not be possible to replicate the returns of any index, as the index may not include any trading commissions and costs or fees, may assume the reinvestment of income, and may have investment objectives, use trading strategies, or have other materials characteristics, such as credit exposure or volatility, that do not make it suitable for a particular person. This is not an offer or solicitation for the purchase or sale of any security, investment, or other product and should not be construed as such. References to specific financial instruments and to certain indices are for illustrative purposes only and provided for the purpose of making general market data available as a point of reference only; they are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities. Investing in securities and other financial products entails certain risks, including the possible loss of the entire principal amount invested, as the value of investment can go down as well as up. You should obtain advice from your tax, financial, legal, and other advisors and only make investment decisions on the basis of your own objectives, experience, and resources.

Brenton Point accepts no liability for any loss (whether direct, indirect or consequential) occasioned to any person acting or refraining from action as a result of any material contained in or derived from this Report, except to the extent (but only to the extent) that such liability may not be waived, modified or limited under applicable law.

This Report may provide addresses of, or contain hyperlinks to, Internet websites. Brenton Point has not reviewed the linked Internet website of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for your convenience and information, and the content of linked third party websites is not in any way incorporated herein. Recipients who choose to access such third-party websites or follow such hyperlinks do so at their own risk.

All marks referenced herein are the property of their respective owners. This Report is licensed for non-commercial use only, and may not be reproduced, distributed, forwarded, posted, published, transmitted, uploaded or otherwise made available to others for commercial purposes, including to individuals within an institution, without written authorization from Brenton Point.

Source of data and performance statistics: Bloomberg L.P. and Factset Research Systems Inc.

©Brenton Point Wealth Advisors LLC 2022

Michael Schaus

Director of Market Research

Michael Schaus is the Director of Market Research for Brenton Point Wealth Advisors and Zweig-DiMenna. Since joining Zweig-DiMenna in 1992, his focus has been on macroeconomic research, the analysis of…

READ MORERead Next:

Sign up!

Sign up for our monthly newsletter and get the lastest news and research from our esteemed advisors here at Brenton point. Right into your inbox!

Client Login

Client Login