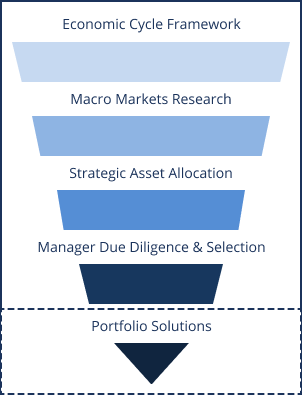

Our independent advisory approach delivers a customized investment strategy utilizing both our proprietary research and investment management expertise combined with vetted investment managers.

Asset Class Research and Analysis

Equity and Fixed Income Research

Co-Investments

Private Investments

Asset Manager Research

Operational Due Diligence

Alternative Investments

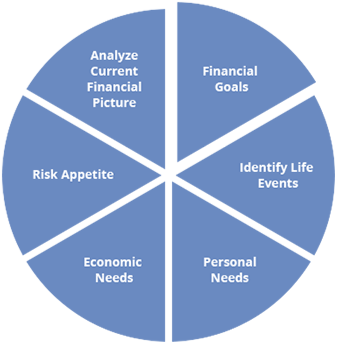

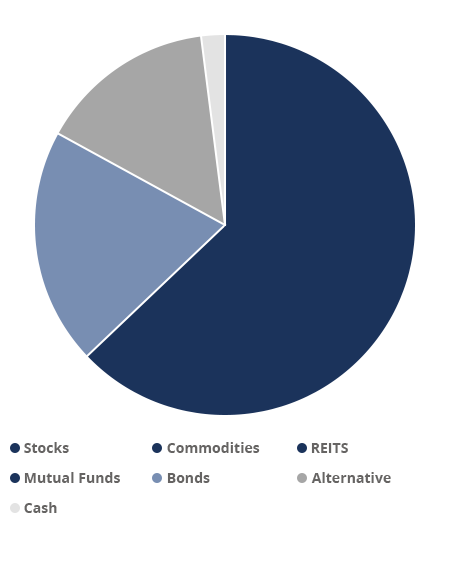

Recommend asset allocation to meet your needs, risk profile and current economic conditions.

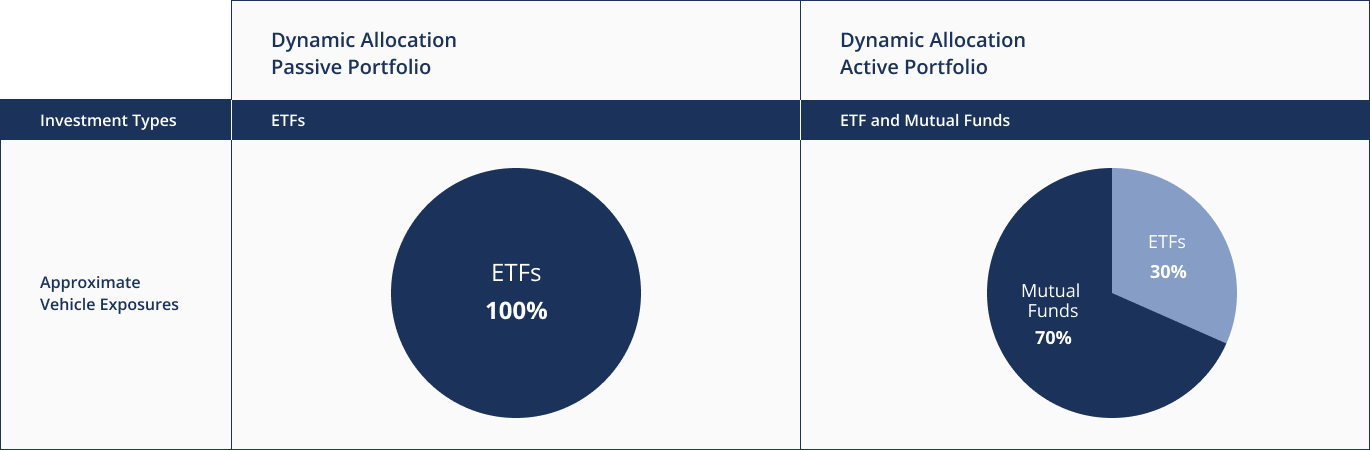

Allocating to direct investments in stocks, bonds, mutual funds, ETFs and other securities.

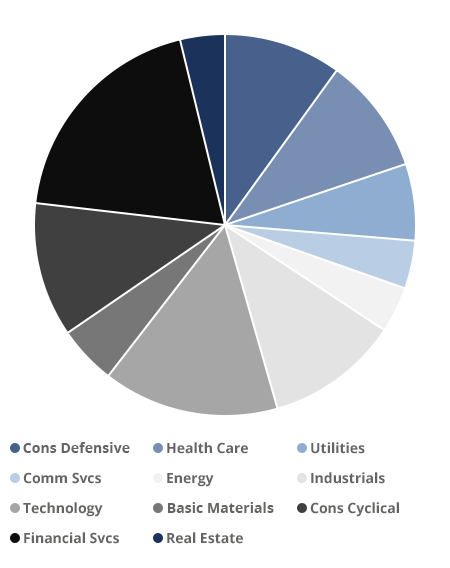

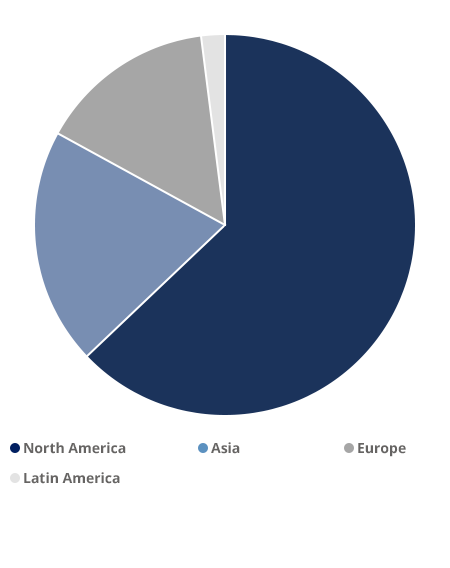

Diversify across sectors and geography.

Access, when appropriate, to external, institutional-quality managers.

Tax-sensitive investing (as appropriate).

Socially responsible investing (as requested).*

Access, when appropriate and requested, to alternative investments, such as:

Our independent advisory approach delivers a customized investment strategy utilizing both our proprietary research and investment management expertise combined with vetted investment managers.

Research driven

Diversified portfolios across assets and geography

Dynamic allocation

Actively managed portfolios

Cost efficient

Based on the research developed under the leadership of Dr. Martin Zweig and Joseph DiMenna and led by Michael Schaus, BP's model portfolios offer an asset allocation solution based on the research tem's macroeconomic investment viewa across major asset classes including equities, bonds commodities and other diversifying liquid investments.

BP's Portfolio Solutions adhere to client risk tolerances while positioning portfolios to meet the current economic landscape.