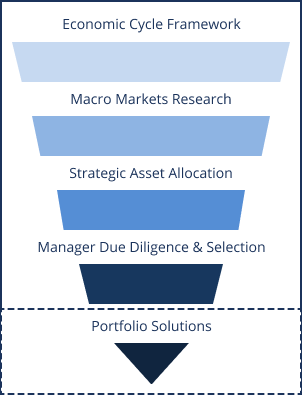

Economic Framework

Economic cycles are one of the foundational concepts of our research and asset allocation guidance.

Macro Markets Research

Assess current market conditions, including the state of the economy, investor positioning, valuation, Federal Reserve policy and aspects of the market.

Strategic Asset Allocation

Evaluate implications for asset classes and assign ratings based on our proprietary outlook.

Third Party Manager Due Diligence & Selection

(as applicable)

Conduct quantitative and qualitative analysis based on analytic screens, asset class expertise, sound operations and adherence to investment process.

Portfolio Construction

Custom discretionary and non-discretionary portfolio construction with adherence to unique client goals and risk parameters.

Advisory Committee oversees investment management process

Our independent advisory approach delivers a customized investment strategy utilizing both our proprietary research and investment management expertise combined with vetted investment managers.

Research driven

Diversified portfolios across assets and geography

Dynamic allocation

Actively managed portfolios

Cost efficient

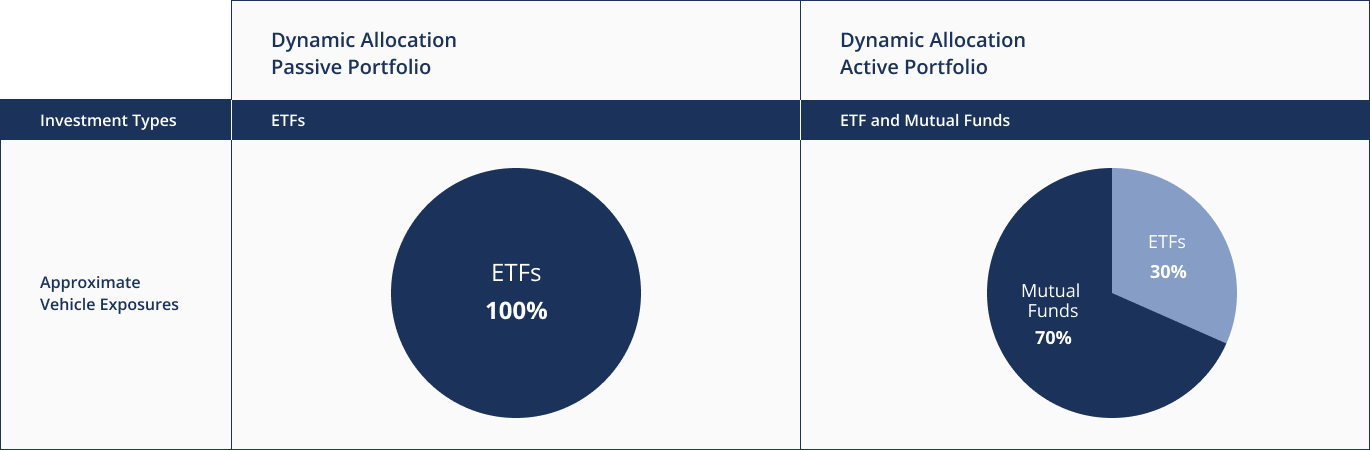

Based on the research developed under the leadership of Dr. Martin Zweig and Joseph DiMenna and led by Michael Schaus, BP's model portfolios offer an asset allocation solution based on the research tem's macroeconomic investment viewa across major asset classes including equities, bonds commodities and other diversifying liquid investments.

BP's Portfolio Solutions adhere to client risk tolerances while positioning portfolios to meet the current economic landscape.

Sign up for our monthly newsletter and get the lastest news and research from our esteemed advisors here at Brenton point. Right into your inbox!