Gold Up 38% Y/Y: Mixed History for Gold

Investing Environment Review and Outlook – Volume 86

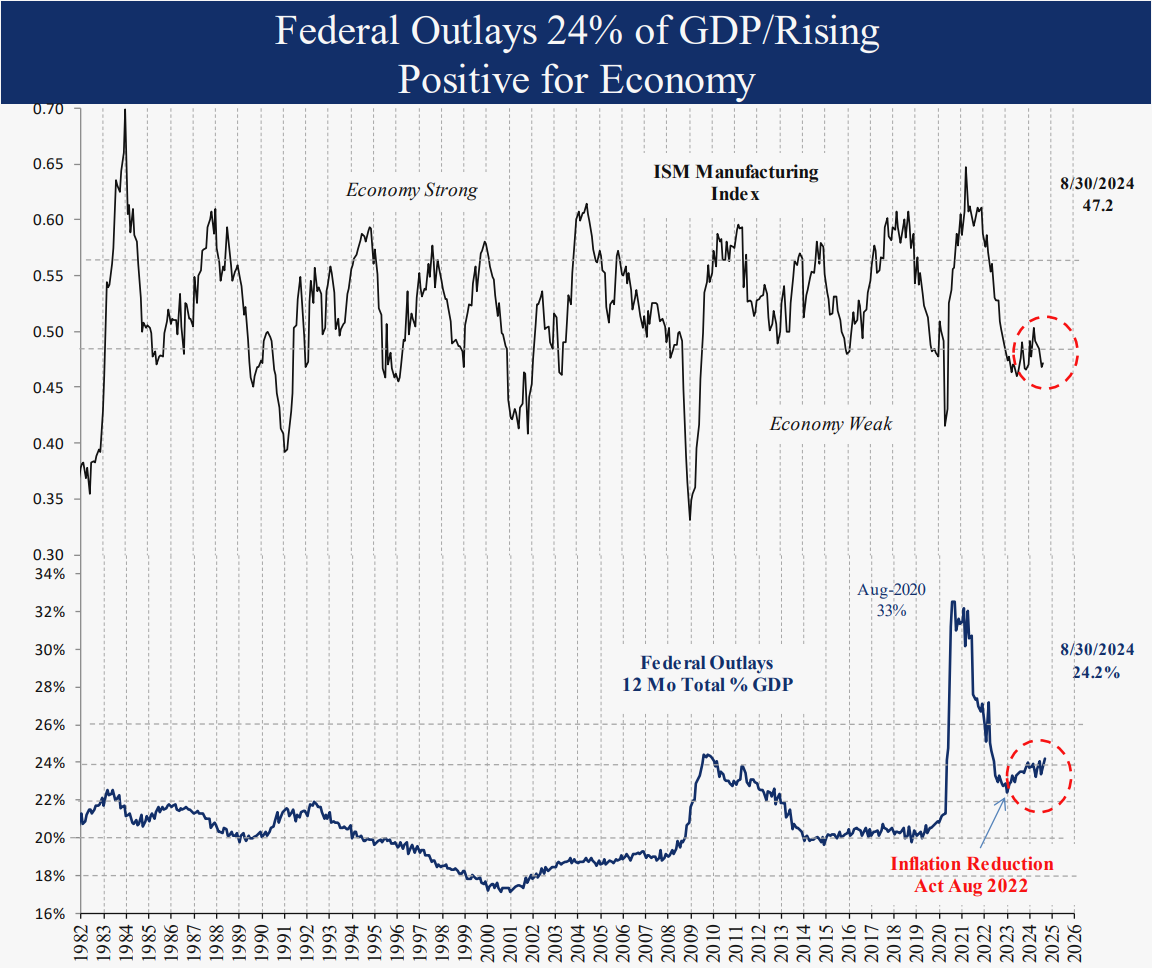

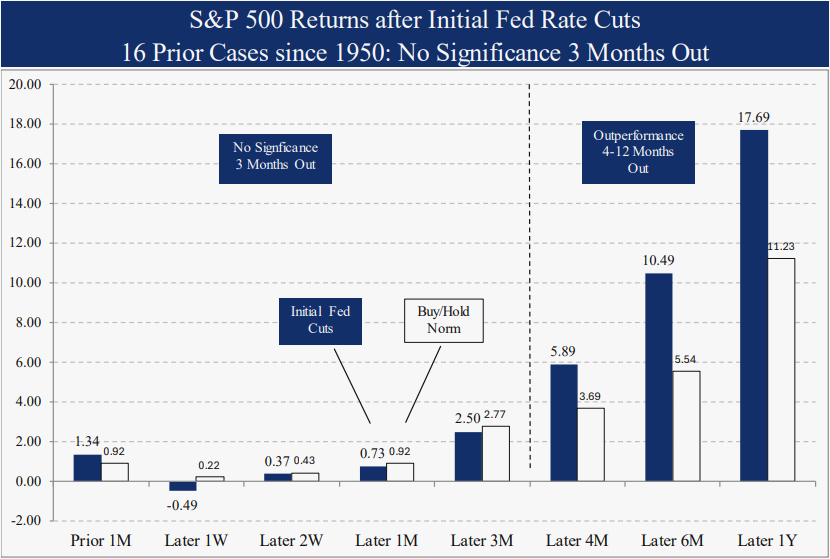

Last month we discussed the initial Fed interest rate cut, investor positioning and the strong Federal outlays. Election analysis has intensified with the election less than a week away. Of the 8 prior presidential elections since 1950 when the S&P was up over 10% Y/Y (vs. 39% this year), subsequent returns varied. The worst two were 2012 and 1988, up 13% and 11% Y/Y prior to the election, followed by 5% declines within one month out. 2000 and 2008 elections were up 4% and down 36% Y/Y prior to the election, then declined 8% and 25% within a month after. The biggest rallies within a month were 1980 and 2020, up 7% and 9%. Economic and monetary indicators usually dominate politics. In 8 prior comparable cases, November and December were up an average of 3.8% and 3.5%, with all but one higher a combined average of 7.3%. The sharp move higher in the 10-year yield from 3.6 to 4.2% is an offset, but conditions remain positive for equities despite the daily election and geopolitical headlines.

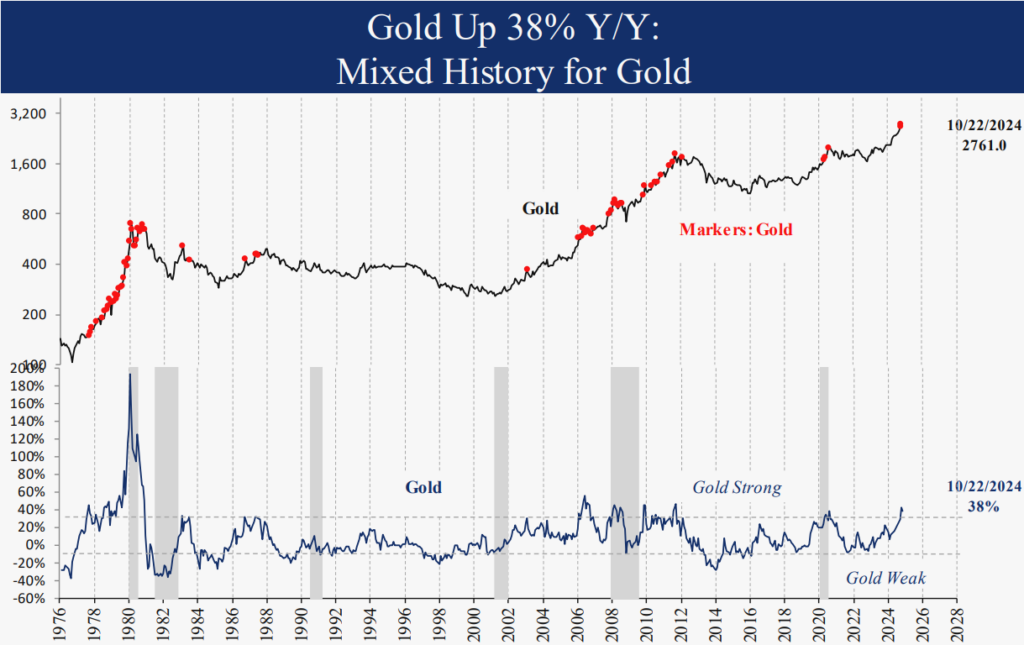

Gold Up 38% Y/Y: Mixed History for Gold

Gold is up 38% Y/Y and 70% over 2 years. Historically, when gold was up over 30% Y/Y, subsequent returns varied significantly. In the 1976-85 period, gold returned 36% annualized while the Y/Y return was over 30%. In 1979, in the biggest gold rally ever, gold peaked with a 190% move in one year. Recently, since 2015, strong returns were also followed by further gains with a 27% annualized return. However, in the 30 years from 1985 to 2015, strong returns like this were followed by weak gold returns from -9% to 2%. This is typical of “overbought” conditions, which are usually followed by low probabilities but higher returns when markets continue trending. We cut gold to a bullish 4 rating based on the overbought conditions, extended investor positioning, and the recent dollar strength.

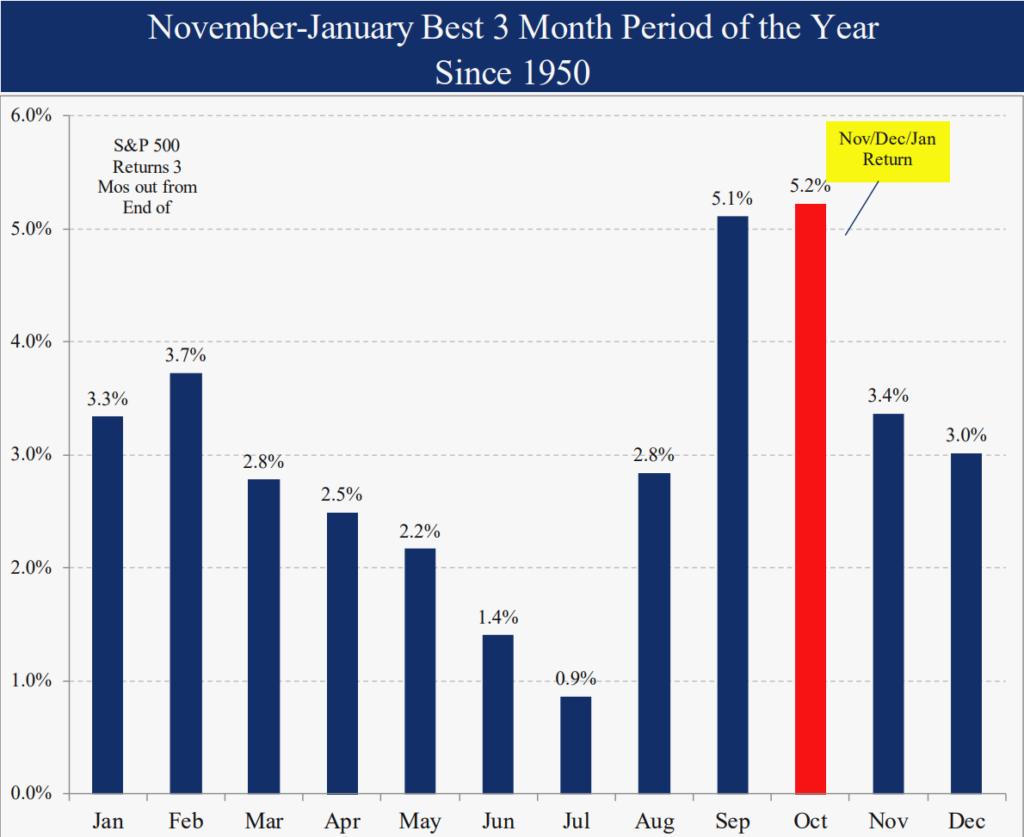

November to December Best 3 Months of the Year

Since 1950, the best 3-month period for S&P 500 returns was November through January at 5.2% with 81% of cases higher. This compares to the worst in August-October at just 0.9% and 57% of cases higher. Averages can be deceiving though. Although investors may remember last year November-January was up 16%, the worst cases included 2007 -10.6%, 2008 -14.1% and 1973 -10.0%. Seasonality is certainly one factor we consider in calculating expected returns and setting exposures, but economic and monetary conditions are generally dominant as predictive factors.

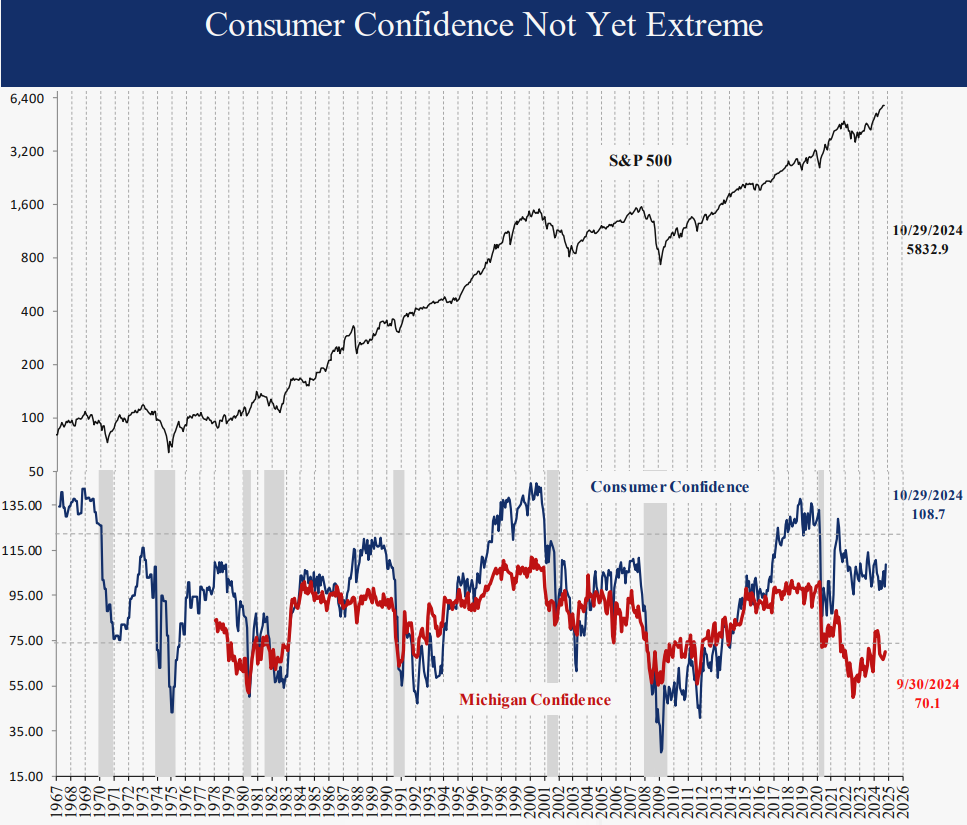

Consumer Confidence Not Yet Extreme: Positive

The Conference Board released their October Confidence measure on 10/29, surprising to the upside at 108 vs. consensus of 99. Confidence is an important gauge we watch to measure risk in equities. During recessions and bear markets, as confidence drops, expected returns for equities rises since expectations are low and bad news is priced into the market. This means the bar is low for upside surprises and higher stock prices. At that point even “less bad” can be enough for a rally. On the flip side, as a bull market matures, confidence rises with stock prices. The highest confidence numbers are predictive of lower equity returns. Readings over 120 marked the euphoric peak markets of 1968, 1999 and 2021. Today, despite a 22% YTD S&P 500 return, Consumer Confidence at 108 is in just the 70th percentile. We continue to monitor economic and market conditions and analyze their impact on asset classes. Thank you for your support and please contact us with any questions.

We continue to monitor economic and market conditions and analyze their impact on asset classes. Thank you for your support and please contact us with any questions.

IMPORTANT DISCLOSURES

This review and outlook report (this “Report”) is for informational, illustration and discussion purposes only and is not intended to be, nor should it be construed as, financial, legal, tax or investment advice, of Brenton Point Wealth Advisors LLC or any of its affiliates (“Brenton Point”). This Report does not take into account the investment objectives, financial situation, restrictions, particular needs or financial, legal or tax situation of any particular person and should not be viewed as addressing any recipient’s particular investment needs. Recipients should consider the information contained in this Report as only a single factor in making an investment decision and should not rely solely on investment recommendations contained herein, if any, as a substitution for the exercise of independent judgment of the merits and risks of investments.

This material is based upon information obtained from various sources that Brenton Point believes to be reliable, but Brenton Point makes no representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date indicated and are subject to change without notice.

This Report contains certain forward looking statements opinions, estimates, projections, assessments and other views (collectively “Statements”). These Statements are subject to a number of assumptions, risks and uncertainties which may cause actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by these forward looking statements and projections. Brenton Point makes no representations as to the reasonableness of such assumptions or the likelihood that such assumptions will coincide with actual events and this information should not be relied upon for that purpose. Changes in such assumptions could produce materially different results. Past performance is not a guarantee or indication of future results, and no representation or warranty, express or implied, is made regarding future performance of any financial instrument mentioned in this Report.

Any benchmark shown herein is shown for illustrative purposes only. No index benchmark is available for direct investment. It may not be possible to replicate the returns of any index, as the index may not include any trading commissions and costs or fees, may assume the reinvestment of income, and may have investment objectives, use trading strategies, or have other materials characteristics, such as credit exposure or volatility, that do not make it suitable for a particular person. This is not an offer or solicitation for the purchase or sale of any security, investment, or other product and should not be construed as such. References to specific financial instruments and to certain indices are for illustrative purposes only and provided for the purpose of making general market data available as a point of reference only; they are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities. Investing in securities and other financial products entails certain risks, including the possible loss of the entire principal amount invested, as the value of investment can go down as well as up. You should obtain advice from your tax, financial, legal, and other advisors and only make investment decisions on the basis of your own objectives, experience, and resources.

Brenton Point accepts no liability for any loss (whether direct, indirect or consequential) occasioned to any person acting or refraining from action as a result of any material contained in or derived from this Report, except to the extent (but only to the extent) that such liability may not be waived, modified or limited under applicable law.

This Report may provide addresses of, or contain hyperlinks to, Internet websites. Brenton Point has not reviewed the linked Internet website of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for your convenience and information, and the content of linked third party websites is not in any way incorporated herein. Recipients who choose to access such third-party websites or follow such hyperlinks do so at their own risk.

All marks referenced herein are the property of their respective owners. This Report is licensed for non-commercial use only, and may not be reproduced, distributed, forwarded, posted, published, transmitted, uploaded or otherwise made available to others for commercial purposes, including to individuals within an institution, without written authorization from Brenton Point.

Source of data and performance statistics: Bloomberg L.P. and Factset Research Systems Inc.

©Brenton Point Wealth Advisors LLC 2024

Michael Schaus

Director of Market Research

Michael Schaus is the Director of Market Research for Brenton Point Wealth Advisors and Zweig-DiMenna. Since joining Zweig-DiMenna in 1992, his focus has been on macroeconomic research, the analysis of…

READ MORERead Next:

Sign up!

Sign up for our monthly newsletter and get the lastest news and research from our esteemed advisors here at Brenton point. Right into your inbox!

Client Login

Client Login